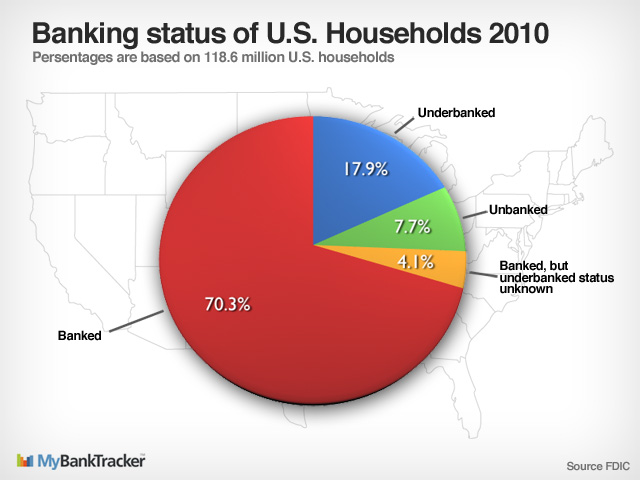

A recent FDIC survey has determined that 51 million adult Americans are either "unbanked" or "underbanked." These individuals are those who either have no relationship with a bank (not even a checking account) or have a tenuous relationship with a bank but still rely on alternative financial services like check cashing and payday loans. Furthermore, most of these individuals and households have no savings accounts. Without savings, these Americans have a significant problem when they incur unexpected medical treatment or procedures. The bills pile up fast; there is no savings to fall back on and often times, the medical provider is left with drawn out payment plans or no payment at all. Patient financing could be the answer.

A recent FDIC survey has determined that 51 million adult Americans are either "unbanked" or "underbanked." These individuals are those who either have no relationship with a bank (not even a checking account) or have a tenuous relationship with a bank but still rely on alternative financial services like check cashing and payday loans. Furthermore, most of these individuals and households have no savings accounts. Without savings, these Americans have a significant problem when they incur unexpected medical treatment or procedures. The bills pile up fast; there is no savings to fall back on and often times, the medical provider is left with drawn out payment plans or no payment at all. Patient financing could be the answer.

Banks can use Patient Financing to Help

The MyLoans™ software allows banks and medical providers to work together to create patient financing at a fair and unchanging interest rate, provided by a federally insured and fully regulated financial institution. The medical providers get immediate funding. The bank gets a new customer and interest income in exchange for servicing the loan. So in a time when so many Americans are "unbanked" or "underbanked," MyLoans™ provides an opportunity for banks and medical providers to work together and provide a much better alternative for patients.

About MyLoans™

By providing patients with fast access to medical loans at a fair and unchanging interest rate, the MyLoans™ software by Epic River enables financial institutions to ease the financial stress of health care through collaboration with medical providers. Not only can medical providers offer a federally insured and fully regulated financial agreement between banks and patients for medical care needs, but doctors and hospitals alike can finally get immediate funding of their patient’s outstanding balances. Additionally, financial institutions gain new customers and interest income with little administrative overhead in exchange for servicing the loan. For more information, visit www.myloans.co.

About Epic River, LLC

Since its inception in 2005, Epic River has been providing high quality software services aimed at solving process-intensive problems. With a focus on high quality and rapid delivery, Epic River’s methodology accelerates the process of innovation while keeping a firm grasp on the business case behind the application, enabling our partners to grow their market leadership. The company’s unique approach to the agile methodology and user experience ensures both parties work closely together every step of the way. Whether you’re looking to expand into new technologies or markets, need a custom internal tool, assistance with architecture, or simply need someone you can trust to make technology decisions, Epic River is at your service. For more information, visit www.epicriver.com.

Leave a Comment