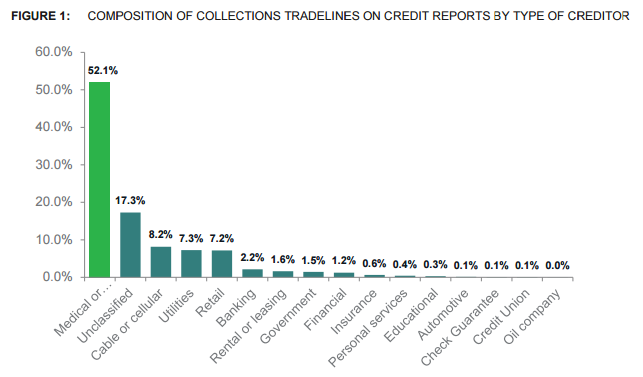

Half of all debt on consumer credit reports is due to medical debt. Medical debt, more often than not, comes from an unexpected event or illness. Let's walk through an extreme, but not unlikely, example. One day a person has a decent job, health insurance, and a savings account. They make all their credit payments on time and have a decent credit rating. The next day, this person is in a severe car accident. The person is transported to the emergency room via ambulance. The person's condition is evaluated and determined that surgery is necessary. Surgery goes well, but the person has a long path to recovery. They stay in the hospital for a while and then the doctor determines they are well enough to continue recovery from home. All necessary medical equipment is sent to their home. After a period of time, the person is well enough to start physical therapy. Physical therapy sessions are more frequent in the beginning, but the doctor recommends they continue the therapy for several months.

Half of all debt on consumer credit reports is due to medical debt. Medical debt, more often than not, comes from an unexpected event or illness. Let's walk through an extreme, but not unlikely, example. One day a person has a decent job, health insurance, and a savings account. They make all their credit payments on time and have a decent credit rating. The next day, this person is in a severe car accident. The person is transported to the emergency room via ambulance. The person's condition is evaluated and determined that surgery is necessary. Surgery goes well, but the person has a long path to recovery. They stay in the hospital for a while and then the doctor determines they are well enough to continue recovery from home. All necessary medical equipment is sent to their home. After a period of time, the person is well enough to start physical therapy. Physical therapy sessions are more frequent in the beginning, but the doctor recommends they continue the therapy for several months.

This whole time the person has been unable to work. Health insurance covers a portion of the emergency expenses, surgery costs, and a few of the physical therapy sessions; however, the person could still be on the hook for several thousand dollars. The person begins receiving bills but is unable to pay the large, unexpected expense before the bill is sent to a collection agency.

Based on a CFPB report, 43 million Americans have unpaid medical debt on their credit report. 15 million of these consumers ONLY have medical debt on their credit reports. So they have done everything they can to avoid debt and poor credit scores and then are penalized by an unexpected medical emergency. Even after this person recovers and gets back to work, this medical debt can exist on their credit report for 7 years, meaning the effects of this accident can influence every financial decision they make for the next 7 years.

Getting medical care should not make your credit report sick. -Richard Cordray, CFPB Director

The CFPB is working to improve reporting because a scenario like this does not necessarily mean that the consumer is less creditworthy. While reporting changes will certainly help the situation, they will take years to have an impact and only address the historical review of the problem, not the problem itself. The real problem is most patients are not able to pay large deductibles and a healthcare provider's 12 or 18 month payment plan doesn't cut it anymore. The CFPB is working on the credit bureaus and credit reporting, but medical providers owe it to their patients and their patients' credit scores to provide them a feasible alternative.

In many cases, the only alternative to adverse impact on people’s credit is a vehicle like MyLoans that can break large, lump sums into more manageable installments that can fit into peoples' monthly cash flows. By and large, people want to pay their bills, but just need a fair and equitable way to do it over time.

About Epic River

Since its inception in 2005, Epic River has been providing financial institutions with software and services for process and revenue improvement. MyLoans, our Patient Lending solution, partners financial institutions and healthcare providers to offer low interest loans to cover patient balances. Practices, surgery centers and hospitals get immediate funding of their patient’s outstanding balances and patients avoid financial harm.

Leave a Comment