"Eat right."

"Exercise daily."

"Exercise daily."

"Pay your credit card off every month."

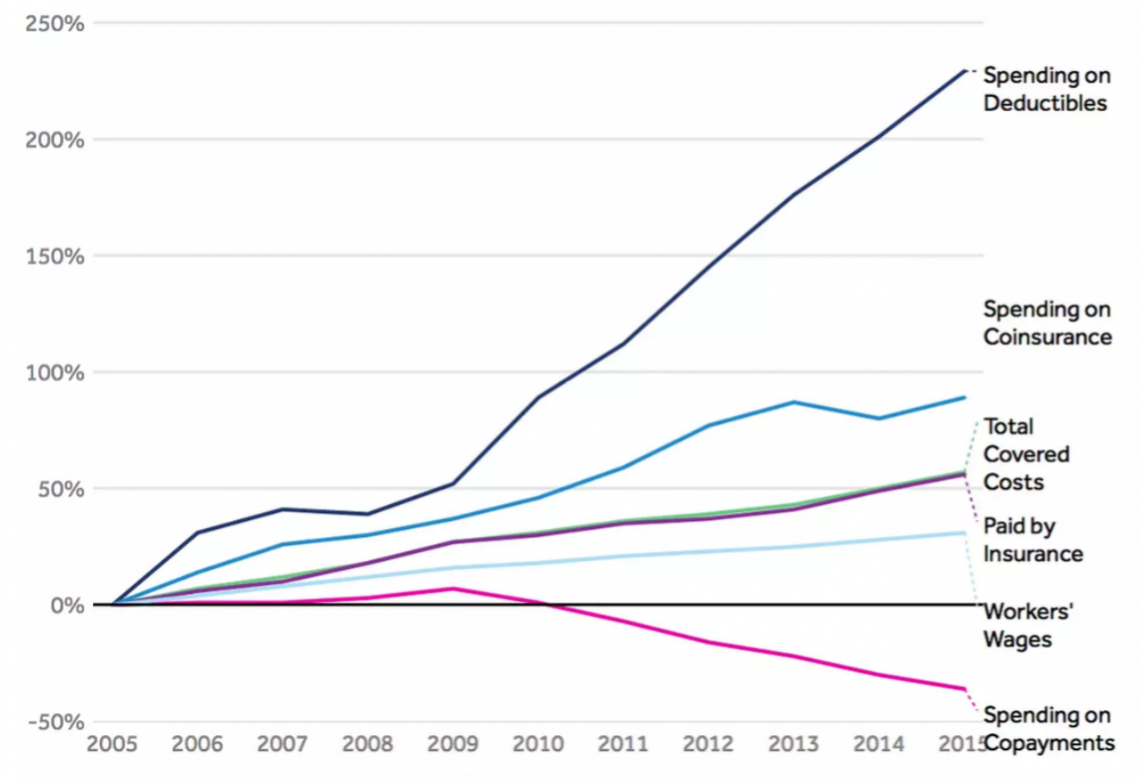

Just because something is common knowledge doesn't mean everyone follows it. Eating right and exercising takes time and dedication, but for some of your patients, paying off a credit card bill every month simply isn't possible because of math. This chart accurately depicts the paltry wage increases compared with drastic increases in healthcare insurance deductibles.

The widening of this gap can be directly correlated to the increase in credit card debt we have all heard so much about. But what gets far less attention is what happens when your patient puts a medical bill on a credit card and pays it off over time. Not only does it add a compounding interest expense to the monthly cashflow, but it actually hurts Four Times. Thanks to our friends at LifeHacker we can take a look at the four ways a medical bill can negatively impact your patient's credit score -

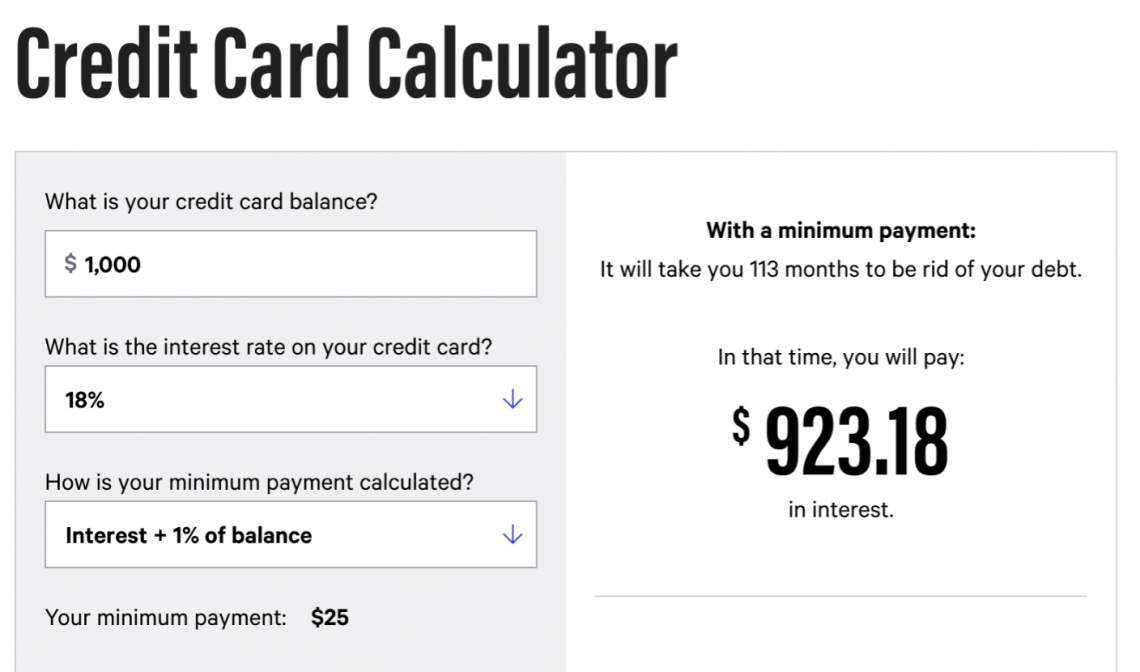

1 - Compounding interest makes it harder to pay off

This one is pretty obvious. Credit cards use compounding interest. So they are charging interest on interest. Ever day. Obviously getting that bill paid off is the most important thing for your hospital, system, surgery center or practice. The problem is you're just kicking the issue down the road. If your patient puts $1000 on an 18% credit card and they are making the minimum payment, it will take over 10 years to pay it off and they'll pay $923 in interest.

This one is pretty obvious. Credit cards use compounding interest. So they are charging interest on interest. Ever day. Obviously getting that bill paid off is the most important thing for your hospital, system, surgery center or practice. The problem is you're just kicking the issue down the road. If your patient puts $1000 on an 18% credit card and they are making the minimum payment, it will take over 10 years to pay it off and they'll pay $923 in interest.

2 - Credit Utilization

Every time a bill is added to a credit card the amount of credit being utilized goes up. Credit utilization contributes to 30% of the credit score calculation. Using a high percentage of your credit negatively affects a third of your credit score. So if a perfect credit score is 850, utilization accounts for 255 points.

3 - Credit Mix

When you have a good mix of different credit types (installment loans, credit cards, mortgage, etc) and you are making positive payments on them, it shows that you can handle a variety of debt. When all you have is credit card debt, this counts against 10% of the credit score calculation or 85 points.

4 - Inquiries

While this one has the lowest impact, when you're fresh out of school and trying to build credit or you've had a misstep in your past and you're trying to rebuild, every little bit helps. When a credit card company pulls your credit report, it negatively impacts your credit score. This activity drops off your report after one or two years, but it does impact the 10% of your credit score associated with new credit which again equates to 85 points.

Adding $1000 medical bill to your monthly credit card payment can take almost a decade to pay off and negatively impact 425 of the 850 possible points towards your patient's credit score.

Epic River's Patient Lending Can Help

Our program does not cost anything for your hospital or practice and our fixed rate, simple interest patient loans are very beneficial to your revenue and your patient's credit. Our loans make medical bills easier to pay off, do not impact credit utilization, improve credit mix and avoid a costly credit inquiry for your patients.

About Epic River

Since its inception in 2005, Epic River has been providing financial institutions with software and services for process and revenue improvement. MyLoans, our Patient Lending solution, partners financial institutions and healthcare providers to offer low interest loans to cover patient balances. Practices, surgery centers and hospitals get immediate funding of their patient’s outstanding balances and patients avoid financial harm.

Leave a Comment