The market for revenue cycle management (RCM) solutions is projected to hit almost $100 billion by 2028.

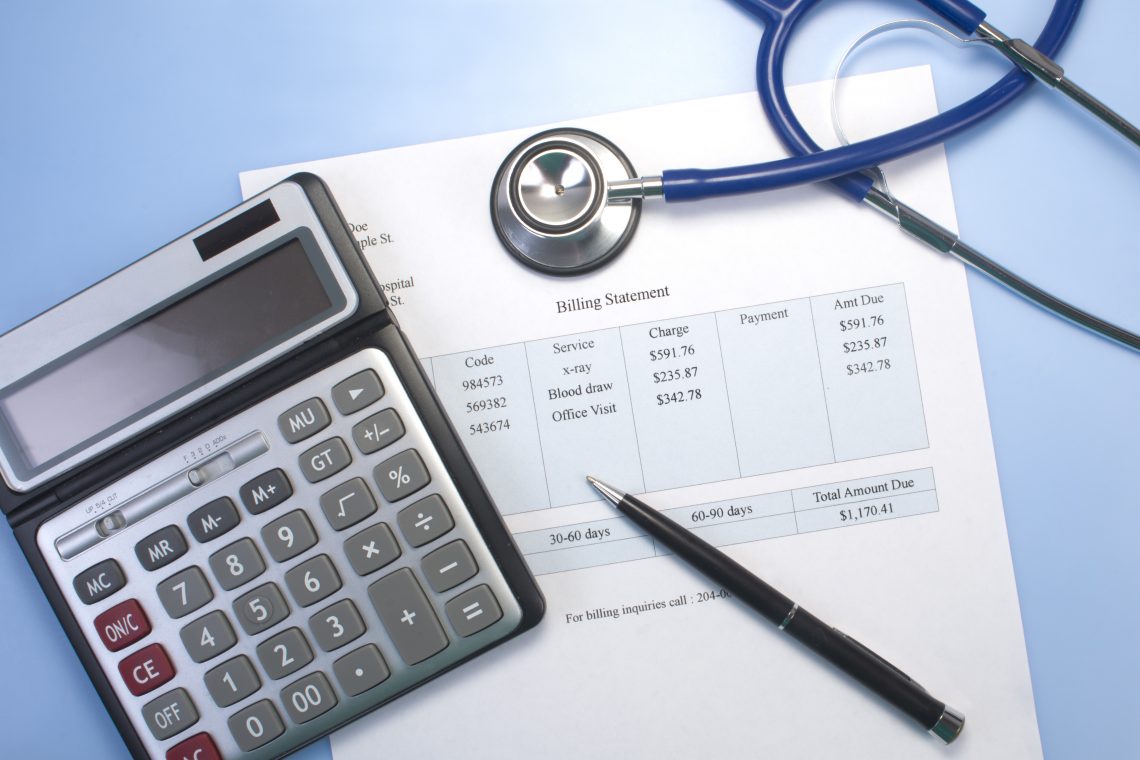

Revenue cycle management solutions are all about improving billing workflow to improve profits for practices and hospitals. And with bad debt as a major contributor to dwindling healthcare margins, patient loans have become a popular solution.

Is your bank is searching for opportunities to take advantage of the booming RCM services market? Keep reading for the 3 reasons you need to add medical lending to your portfolio.

1. Disposable Income Rising

As disposable income rises, patients spend more on healthcare services. And according to the United States Personal Income Report, disposable personal income rates hit an all-time high in May of 2019.

Patients may have more money to spend on healthcare today. But increasing prices and out-of-pocket responsibilities mean the burden of the cost lies mostly with the patient.

2. Insurance Rates Plummeting, HDHPs Increasing

With the recent elimination of the individual mandate, insurance rates in the US are plummeting. At the same time, High Deductible Health Plans are more popular than ever among healthcare consumers.

Combined, this means patients are frequently paying out-of-pocket for care, care they may not be able to afford in one lump sum.

3. Healthcare Costs Growing

According to a market research report, provider workload has grown substantially over the past few years. Meanwhile, payer reimbursement rates have dropped. To assure they’re paid for their work, providers are hiking up the cost for healthcare goods and services.

This has helped improve provider revenues, but it’s also a setback for uninsured and HDHP patients who want to spend more on healthcare.

Medical Lending Helps Patients Access More Health Care Goods and Services

Bill pay solutions like patient loans help offset the negative effects of the individual mandate elimination and the rise of HDHPs. They help consumers access pricey procedures, goods, and services by giving patients the option to pay over time.

Best of all, medical lending programs connect banks like yours with customers in an industry that has nowhere to go but up.

Interested in learning more about patient loan services? Get in touch with Epic River to find out how to become one of our partner banks.

Leave a Comment